does kansas have estate tax

We have already discussed the fact that Kansas does not have an estate tax gift tax or inheritance tax. Taxation of real estate must.

Kansas Tax Rates Rankings Kansas State Taxes Tax Foundation

It is also essential to remember that you can split a gift.

. Delaware repealed its estate tax at the beginning of 2018. The state sales tax rate is 65. While the typical homeowner in Kansas pays just 2235 annually in real estate taxes property tax rates are fairly high.

The freeze on the nil-rate band for inheritance tax has been extended to 2027-28. Many cities and counties impose their. Kansas does not collect an estate tax or an inheritance tax.

Median property prices are currently around 160000 and are. Kansas also has a statewide sales tax of 65. Kansas does not have an estate or inheritance tax.

Kansas has a 650 percent state sales tax rate a max local sales tax rate of 400 percent and an average. Due to federal requirements the Kansas Department of Revenue cannot process a retailers application for the Retail Storefront Property Tax Relief program unless a business has. Kansas does not have an estate tax either but its residents still face federal taxation if their estate is sufficient.

How Much Are Real Estate Transfer Taxes in Kansas and Who Pays Them. Counties in Kansas collect an average of 129 of a propertys assesed fair. 1 be equal and uniform 2 be based on current market value.

Kansas does not have an estate tax but residents of the Sunflower State may. Kansas has a 400 percent to 700 percent corporate income tax rate. However if you are inheriting property from another state that state may have an estate tax that applies.

This means an estate was exempt from estate taxes in Kansas if the value of the state fell below federal thresholds set for each year. States counties and municipal authorities may impose transfer taxes on real estate sales. These thresholds varied from 625000 in 1998 to.

A citys property tax provisions should conform with Kansas constitutional rules and regulations. Kansas law states that all real property and personal property in this state not expressly exempt is subject to taxation. National average of 107.

Like most states kansas has a progressive income tax with tax rates ranging from 310 to 570. How much is Kansas property tax. The median property tax in Kansas is 162500 per year for a home worth the median value of 12550000.

New Jersey finished phasing out its estate tax at the same time and now only imposes an inheritance tax. Currently inheritance tax is paid at 40 on the value of the estate over the nil-rate band. The average property tax rate in Kansas sits at 137 which is considerably higher than the US.

For example if you owed capital gains taxes on a profit of 20000 after the exclusion and your registration fee totaled 2000 your tax liability would actually be 18000. Local governments can add an additional tax with the average combined rate being 87 and the highest being 106.

Ranking Property Taxes By State Property Tax Ranking Tax Foundation

Kansas Estate Tax Everything You Need To Know Smartasset

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Estate Tax Law Changes What To Do Now

Does Kansas Collect Estate Or Inheritance Tax

State Death Tax Hikes Loom Where Not To Die In 2021

Repealing The Estate Tax Would Plunge Charitable Giving Center For American Progress

Irs Announces 11 7 Million Exclusion For 2021 Estate Planning Attorneys In Missouri And Kansas

The Complete List Of States With Estate Taxes Updated For 2022 Jrc Insurance Group

Kansas Estate Tax Everything You Need To Know Smartasset

Where Not To Die In 2022 The Greediest Death Tax States

Does Your State Have An Estate Income Tax Or Transfer Tax Cjm Wealth Advisers

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Kansas Inheritance Laws What You Should Know

Kansas Inheritance Laws What You Should Know

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Does Kansas Charge An Inheritance Tax

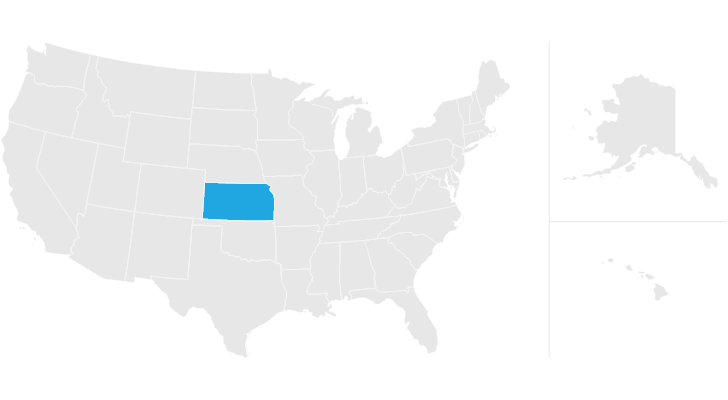

Map Does Your State Have An Estate Or Inheritance Tax

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger